By: Yazhou Hu, CEO & Founder of SF tax

It was a sunny day; my family went out for a farm activity in the middle of Ohio strawberry field with another family. Kids were playing around with happy face and laughter. Jerry who is the man of the other family came up to me with a workaholic tone and said, “Can you help me to do my partnership business tax? You are a CPA, right?” looking at him with a serious look on his face, I responded, “Yeah I am a CPA, but I don’t do tax.” “You can just do it for me, I will pay you.” He insisted. I knew he was in the real estate construction industry business, so I explained, “I do IT audit for commercial banking industries, and I can’t help much when it comes to doing taxes.” Jerry tried again to convince me into doing his partnership real estate tax, but I rejected for the same reason.

Deep in my heart, I really wanted to help him, in fact I really wanted to help him in terms of tax planning, tax strategies, different tax cases for him to lawfully avoid potential tax liabilities. I don’t want to just collect $400 dollars and prepare a partnership tax and be done with it. That in my opinion is not honest.

Information is flooded on the internet, every day, we are filled with information around us and either we avoid some of the unnecessary information or we are force to be driven by the direction of medias. What we hear from the professional services provider all the time is how good they are with their services; how many 5 start reviews they received in the past year. The society demands honest answers. If a professional services provider tells you they are good at what they do, we might want to ask the question, “How?”, what makes you stand out on the services you do, what differentiates you from others who are doing the same services.

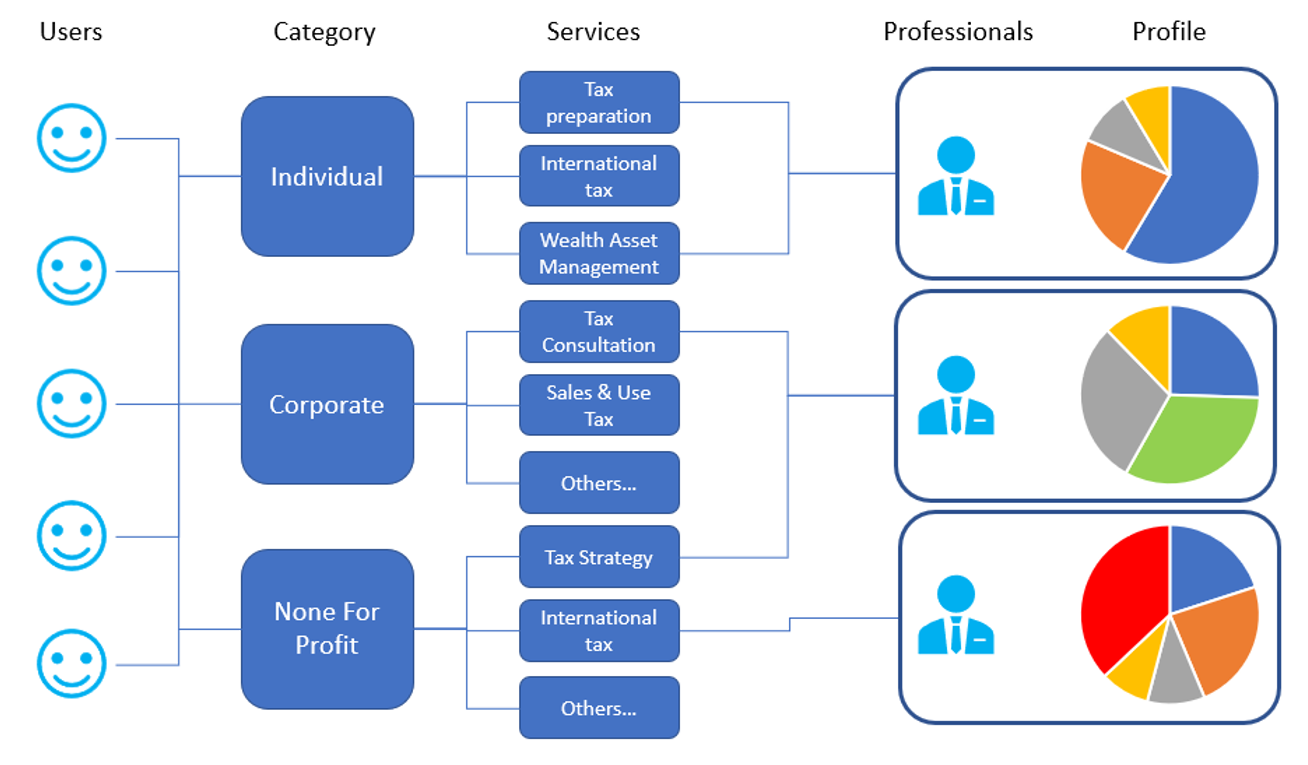

When a tax professional list their services online to the internet. The entire nation can get to see you. People doesn’t want to know the “what” services you provide, they want to know the “why” is your services better than the others. I spent a lot of time researching to understand the “why” tax client shops for the tax professional business. In simple terms, they are the expertise, specialization, experience, preference and culture.

Expertise is the amount of research you do on the tax topics related to your client, US is a legislative legal system, court cases can be applied to other potential customers with similar business or individual situations. Expertise can also be related to your specific tax research topics such as how can someone benefit from one tax law better than the others. What taxation system can be used for different industries. For example, Financial banking industry doesn’t use medical industry tax software. State and local governments have government, private sector accounting methods. Which one has more benefits for the current business in different types of industry, S corp or LLP? Etc.

Specialization relates to the type of service a tax professional do, or the specific industry you worked with historically. For example, some of the tax professional (CPAs) I talked to worked on Wealth Asset Management for individuals and these individuals are specifically from banking industries. Some of the tax professionals worked only on partnership tax, and the partners are in the alternative investment group (hedge funds, financial vehicles and derivatives). A tax professional with specialization in Marijuana growing business is very different than someone from chemical manufacturing. It is not possible to have an absolute specialization in one type of business structure, or one type of industries. However, tax professionals can do one more than the others.

Experience shows the number of years the tax professional performed. The experience how only demonstrates the professionalism, it shows how much of the professional’s prior experiences can be applied to the new clients. Professional services leverage deep thought process to carry beneficial information across to other clients. For example, a well experienced restaurant tax professional can share invaluable tax strategies for other clients who are also in the same restaurant business industry because the professional just know all the detail tricks that other restaurants do. Same thing with mining, manufacture, logistics, professional service, education, hospital, church, etc… IRS releases around 450 different industries codes. And if a tax professional who worked on 7 years on construction companies to do tech company taxes, this can be taking chances.

Preference comes into play when the tax professional’s firm would prefer specific type of clients more than the others. For example, during a firm growth (2 tax professionals to 6 professionals), the firm would prefer more specific type of clients than the others. Small business (revenue less than 1 million annually) clients in the logistic industry, or medium sized (revenue greater than 1 million and less than 5 million) business in the construction business and stop accepting individual tax returns for non-efficient business processing reasons. This is not because of setting preferential on tax clients, it is about a health growing business need.

Culture, last but not least, is so important that it has a super impact on us doing businesses. I met CPA who speaks Vietnamese, Japanese, France, etc. They are rare gems to find. Culture can instantly build trust and be a vessel to establish connections. Many tax clients are looking to find CPAs who are good at the work and knows about their cultures. Cultures also impacts on how we do things; some eastern culture has different approach on understanding debt and liabilities. A tax professional who understands the culture can help the client more efficiently.

We talked about all these differences can make a professional be a good fit for the clients, and from my personal experience, I knew I was not going to be a good fit for Jerry’s business needs. I already have my specialization in IT audit services as a professional for banking. But this burning desire that I wanted to help him still exist today. I really wanted to help him finding a good tax professional, who does well in partnership tax, with real estate construction business experiences and charges a reasonable price for his startup company.

And here I am today to build this honest specialization-based connection market network. To let people, know about my specialization in an honest way. And any tax professional registering on this market network can demonstrate all of the 5 difference we talked about above honestly. We are not going to see, “We are the best at what we do!”, “The NO.1 CPA in XXXX state”, “Best CPA firm in town”, we will see the individual with honest presentation about themselves on their expertise, specialization, experience, preference, and culture. The “Why” that attracts quality clients, the reason that the professionals are good at what they do. I hear so many people claim that they don’t really find good CPAs, the professionals that are good at their work. The reason is we were always told they are good at all of what they do, but not the “why”.

This is Yazhou Hu, CEO and Founder of SimpleFunTax professional service streaming market network. I am looking for you to join this honest network.