Traditional relationship-based connection

Have you ever met a tax professional who claims he or she is good at all the service they offer? Chances might be yes you have. The tax professional is trying to earn your business and trust, however later you might find out they are not so good at what you specifically requested. This is a common scenario for tax professional services. Since the business relationship is built on relationship, we call this a relationship-based connection. Let us look at a real-life scenario.

Amy is a tax service provider with five years of public accounting experience. During tax busy season, Cathy referred Bob as a client and engaged Amy to file an individual tax return for $350. Cathy built a relationship based connection with Amy on a none-for-profit church tax return. Amy would love to help Bob out since she believes Bob can refer another client to her within Bob’s relationship network. If I am going to let all of us to finish the story here, this scenario will continue with the relationship-based connection, Bob will refer Dan, Dan will refer Esther, the list goes on, Amy will become a successful firm partner and grow her business happy ever after. However this scenario has an unknown fact to Bob, Cathy, or any other people including us, Amy had a good four years of experience filing partnership tax return and had a lot of knowledge in marijuana farm growing industry. Should Amy be connected with a client that was in marijuana farm growing industry and looking for a partnership tax filing, her service revenue would look like the diagram on the right (Refer to Figure 1).

Figure 1

While the partnership 1065 form might take more time to work on, it certainly worthes the extra $900 of service revenue. This is a typical result of relationship based connection, and this traditional business model increases the amount of opportunity cost for tax professionals to perform better, more efficient and more profitable professional service. It also increase the opportunity cost for a tax professional to create more value (potentially saves more money) for the tax clients. Imagine Amy could do all partnership 1065 tax returns the entire busy tax season instead of the individual tax, chances are her busy seasons will last only about a couple of weeks of 70 hours/weekly against six months plus of exhaustiveness. Amy will also be able to help more client with their partnership taxes to save more money.

Traditional relationship-based connection network

As a result of the physical geographic location limitation, the tax professionals are forced to build their business on relationship-based connection, since there are only a radius of clients that a tax professional can serve, they are forced to enter into the relationship-based connection in order to remain in competition. At any given US location, search for CPA in google map, this is what we get (refer to Figure 2). The problem here with building tax business only based on relationship can hinder the tax professional’s expertise, specialization, experience, preference, and culture to be appropriately presented like the scenario described above.

Figure 2

Figure 3

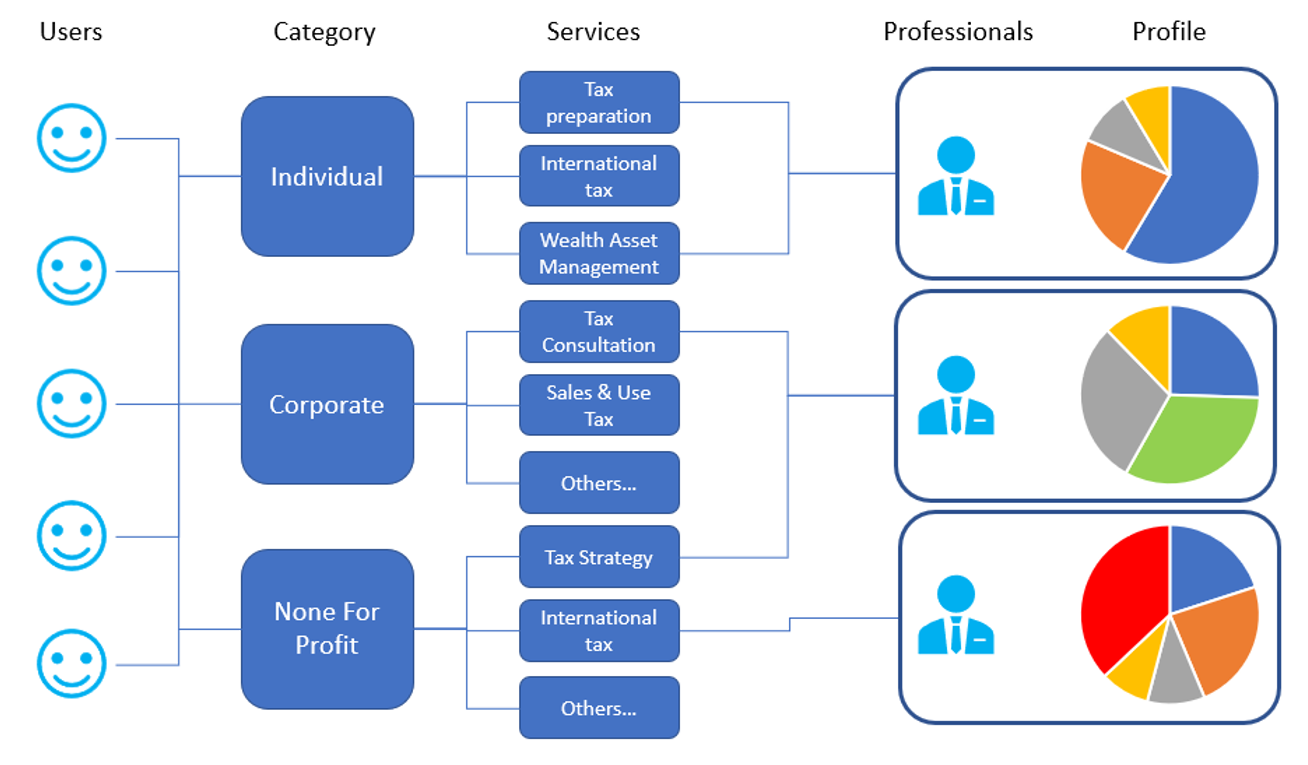

Innovative specialization-based connection

There can be a solution for this which is to build the tax business not only based on relationship, but also based on the specializations. There are many professional tax services, tax filing preparation, wealth management, partnership base allocation, state tax, debt resolution, just to name a few. When it comes to two tax professionals who provide the same service, it is really a matter of their expertise, specialization, experience, preference, and culture based on the tax professionals. Some tax professionals worked on individual high wealth management more than corporate business taxes, some worked more on none for profit in the health care or charity industry more than partnership in real estate. When finding a tax professional, knowing their specialization and expertise can frequently establish additional trust in the initial conversation. For example, a patient would not want to talk about his concerns with his liver when meeting with an eye doctor, right? Knowing your tax professional’s expertise, specialization, and experience ahead of time can greatly benefit the communication. How do we achieve this initial understanding of the tax professional? SimpleFunTax market network’s solution utilizes pie charts to clearly demonstrate the tax professional’s expertise, specialization, experience, and preference for tax professionals’ career. Refer to Figure 4. Let us call this a specialization-based connection.

Figure 4

Innovative specialization-based connect network

To build further on the specialization-based connection, the tax professionals can present their expertise, specialization, experience, preference, and culture (let’s call this the “Specializations” in the following paragraphs). In Amy’s example, she can present her specializations in advance for the potential tax clients. This will eventually create Amy’s specialization-based connection network. Refer to Figure 5. Cathy can review Amy’s profile and understand her specialization is in the partnership and marijuana farming industry. Cathy would refer Bob who are also in the same Industry, Bob can verify Amy’s profile and establish specialization-based connection. The connection network can therefore be built and expanded. Amy doesn’t usually disclose her specialization to the client in the traditional relationship-based connection network since she believes it might limit the number of opportunities to onboard new clients. The fact is, if the potential client doesn’t know about Amy’s specializations, there is a high chance the client comes to Amy to consult about his tax service needs and go to someone else. This someone can be their old tax professional who had a closer relationship based on their prior experiences or even simply because someone who has a cheaper rate. This happens because the tax client doesn’t realize the value of Amy’s capabilities (Amy’s specialization) to help him.

Figure 5

The professional service market is crowded, according to IRS released information, in 2019 there were 153 million tax fillers in US. 82 million of them worked with tax professionals, and 71 million of them worked with automated tax software like turbo tax. Based on this, in order to gain new business a tax professional needs to work extra hard in order to earn the customer’s business and trust, however there are only a limited amount of time during tax busy season. Tax professional should demonstrate something more than just relationship to a prospect client. Demonstrating specializations can be the key to build additional trust for the prospect clients. Clients are not looking for “What” service is provided, they are looking for the “Why” (which is the tax professionals’ specialization) to purchase the professional’s service.

Relationship-based connection vs Specialization-based connection

The great COVID-19 pandemic swept American in 2020 and continuously affecting our lives afterwards. This encouraged the tax clients to shop for professional tax service providers on the internet. Operating the professional tax service virtually via the internet is going to be a common option for the tax service provider market. With so many options available and everyone claiming they are the best at their services, who should the client trust? Between a connection only based on relationship or a connection based on specialization? Given both tax professionals have similar license, credential and years of experiences, the answer is easy. The potential tax client is willing to trust on the tax professional’s specializations. Let us simply ask this question, between a general doctor and a cardiologist doctor, a heart disease patient wouldn’t want to risk his life choosing the general doctor to discuss about his heart surgery, right? The potential client wouldn’t want to waste his hard-earning money hiring a general tax professional either. In fact, every tax professional I talked to has their specialties in some services more than the others. What I often hear from a tax client is he has been working with his tax professional for more than 5 years. There is no need to find a more specialized one. The key here is a more specialized tax professional can help you to save more money. We are not there to make friends with our tax professionals after all.

Another question in relation to meeting a tax professional on the internet is how to gain an initial trust, the answer is we gain confidence with our tax professional service provider with their credentials. CPA, EA and Attorney each has their regulatory authority (usually the states) to revoke their license for misconduct behavior. Further the tax client can talk, consult and verify with them to see if they truly have those specialties to save money.

With the power of internet to connect clients and professionals easier, the relationship-based connection network creates this bottle neck where every tax professional has to say they are the best at the services. Professionals are competing with numbers of reviews and constantly need to reduce their rate to remain in competition. Specialization-based connection network really helps tax professionals to restore prestige of the professional services. Tax Professional service is a prestige service experience that a professional can offer to the client based on the client’s specific situations and needs. By disclosing the expertise and specializations, the tax professional is disclosing the hidden prestige value of their service specialties. This hidden value makes the professional service more prestige. If the new tax professional demonstrates the specialization in advance, it can greatly reduce the chance a prospect client shops around tax professional’s services, simply because others might not have the specialization this professional has.

To re-emphasize, the specialization indicates the expertise, specialization, experience, preference, and culture. Finding a good tax professional with the right match to the client’s needs is not easy. Simplefuntax Market Network is here to solve this problem by creating a new type of connection between tax client and tax professionals via the specialization-based connection network.

Relationship based brands & specialization-based professionals

There are about 46,000 CPA firms in US. The number 500th firm has around 20 professionals. The rest of the firms have less and less people. Some of them is more of a family or boutique firm with father and son or daughters and some of the firms becomes phenomenally successful with many talented individuals. They grow by buying and merging with other firms to build a relationship-based brand. The professionals within the brand has mixture of specializations. Some of them are good at real estate and constructions, some of them are good at mining and manufacturing etc. They work with each other to collaborate, share experience and together they build this relationship brand together. (Pay attention to the names of the CPA firms, they usually are the founder’s last name or initials).

However, the relationship-based brand doesn’t directly co-relate to the professional service work quality. If a client reaches out to the firm and request for specific services, the firm might not always have the best professionals to help with the client, they can be working on some other clients. Further, if a partner, director or a manager leaves a professional service firm, their clients follow. Guess what, the client follows the specializations of the professionals. Tax professional industry needs a market network (Refer to Yazhou’s other articles on Simplefuntax Market Network), and this network allows client to reach out to tax professionals within firms and talk to them directly, not only the client can communicate with the tax professionals, it also introduces the client about the services the tax professionals’ team provide and their specializations. A partner and director’s time can be precious, but the members of the team can have more time to introduce about the partner, the team and the service specializations they provide. Refer to Figure 6 for the Simple Fun Tax Market Network diagram. If you are a member of a tax team who wants to demonstrate yours and your team’s specializations for tax services, create your profile and encourage your peers to do the same.

We lived in the relationship-based connection network for so long, and we might trust the brand more than the specialization of professional services. A licensed, credentialed tax professional’s specializations worth more trust than just the brand, if a professional is confident enough to present it, that means they are really good at it. Make sure to talk to them and ask them about the special tax savings, tax strategies with specific industries, business structures, different type of tax services and you will be surprised how simple and fun it is to find your desired tax professional.

Figure 6

Conclusion

I want to bring innovation to our tax professional service industry, where each of the tax professionals and their team can benefit more value from their expertise, specialization, experience, preference, and culture. Where the tax professionals can contribute more values to our prospect clients on the individual, corporate, partnership, none for profit, federal, state, and government tax situations and much more. And all tax clients can truly find their desired tax professionals that understand their situations and needs. Please join me to innovate our industry by passing this message to our fellow tax experts and professionals, let them know that their value is prestige. Let them know the tax industry is a bright night shined by each one of the professional’s uniqueness and specializations.

My name is Yazhou and I am the CEO and founder of Simplefuntax Market Network, I am looking to have you to join our next generation of professional service streaming market network.