By Yazhou Hu, CEO and Founder of Simple Fun Tax

Simplefuntax.com is an industry revolutionary online market network that connects the tax experts with the tax clients based on the expertise, experience, specialization, and preference. Versus the traditional public accounting trust-based client network, Simplefuntax.com introduces specialization-based client network connection that provides more profitable clients and more qualified tax experts. Let’s talk about a scenario. Amy is a tax service provider with 5 years of public accounting experience. During tax busy season, she receives a client request to prepare and file an individual tax return for $350 from Bob. But little do neither Bob, or any other people know, Amy had 4 good years of experience filing partnership 1065 tax and had a lot of good knowledge in marijuana farm growing industry. Should Amy be connected by a client that was in marijuana farm growing industry and looking for a partnership tax filing, her service revenue would look like the diagram on the right. Let us look at Figure 1.

Figure 1

What happened here? Of course we know the partnership 1065 form might take more time to work on, but isn’t it worth the extra $900 of revenue? This is a typical result of traditional trust-based network connection. The $350 individual client request was referred by Amy’s client Cathy. Cathy worked with Amy on a partnership tax return and referred Bob as a client to Amy. Amy would love to help Bob out since she believes Bob can refer another client to her within Bob’s trust network. There is nothing wrong here with the trust network based connection, however this traditional business model increase the amount of opportunity cost for tax experts to perform better, more efficient and more profitable professional service. More importantly, this limits a tax expert to create more value for the tax client. Imagine Amy could do all partnership 1065 tax returns the entire busy tax season instead of the individual tax, chances are her busy seasons will last only about a couple of weeks of 70 hours/weekly vs six months plus of exhaustiveness. Refer to Figure 2 for a typical trust-based network diagram.

Figure 2

We might ask why wouldn’t Amy reject Bob’s client request? Since traditional trust-based network connection is limited by geographic locations, tax experts can lose potential clients if they say they don’t say they are good at everything. If we search “CPA” in any given google map, we get this. Refer to Figure 3.

Figure 3

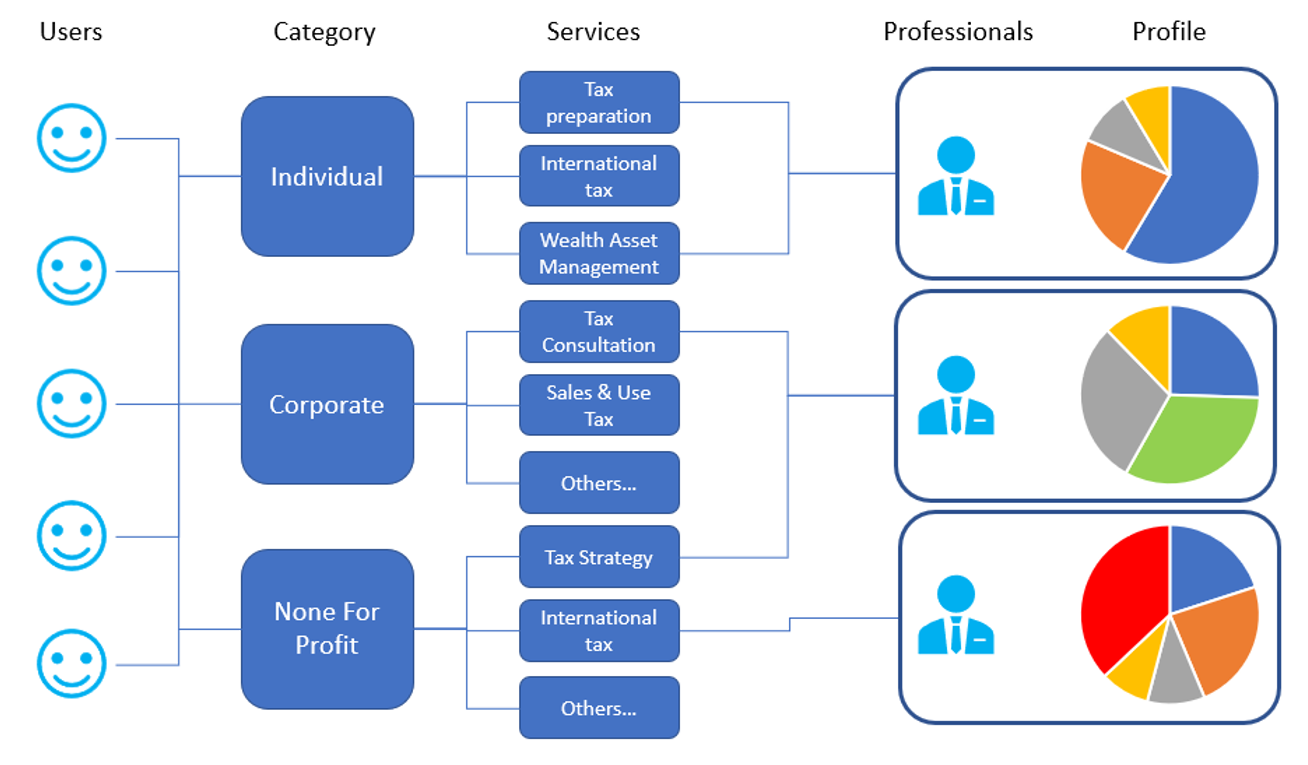

Simplefuntax.com is equipped with the innovative search engine to solve this problem. A tax experts’ profile is presented by a chart below Figure 4. This chart can be freely adjusted by the tax service provider. When a tax client search for the tax experts, the connection is established based on the tax experts’ expertise, experience, specialization and preferences. Refer to Figure 5 for user’s search.

Figure 4

Figure 5

As a result of the specialization based network connection, AMY’s client network connections can be expended to different geographic location. Refer to Figure 6 for Specialization-based network connection.

Figure 6

One concern with respect to the specialization-based connection is how can the tax client trust the tax expert without being within the tax expert’s trust network. According to research and study, tax clients generate more trust when they discover the tax experts’ expertise, specialization, experience and preferences matches the tax client’s situation needs. For example: Would someone hire a general doctor or heart surgeon to perform a heart surgery. The answer is obvious, while we know they are all doctors, but they specialize (good at) in different type of works. While we enjoy the customer service provided by the tax experts, we are not meeting our tax experts to make friends, the more specialized tax experts can save us more money.

Simplefuntax system opens up the full communication channel between the tax experts and tax client to build on further initial trust. We can video or audio chat with each other, leave a message, upload file, and the tax experts can use the web page to manage client, download or upload documents, billing and collect payments. Refer to Figure 7

Figure 7

Simplefuntax APP and Web has a built-in billing and payment system to control the payment flow. This is to ensure fraudulent CPA activity for the best interest of the tax client. It is also for the best interest of the tax experts to issue retainers, subsequent billings, to ensure the legitimate tax experts get paid. The payment system retains 2% of the service revenue from tax experts on top of 3% credit card fee (a total of 5%) for the maintenance of the community to continuously provide better customers, system operation, legal support and many other future of work features and experiences. For a $300 individual return service revenue, the tax expert gets to keep $285.

Simplefuntax is missioned to connect a unique tax expert to the tax client. It is an innovative market network that values the tax experts’ uniqueness in relation to expertise, specialization, experience, and preference. Tax experts are not just another commodity when it comes to connecting potential customers online. Your uniqueness set yourself apart from other tax experts.

I am Yazhou Hu, CEO and Founder of Simplefuntax, I want to bring the tax professional service industry revolution to make tax experts shine. The entire industry is a bright sky because each individual shines with his or her uniqueness. I invite you to join our market network to discover your true potential in related service and magnify your uniqueness in tax professional service to a prestige level.