I have used lion Rex for my business and person taxes for the last three years. Nancy is the one that takes care of me and she is excellent! I had a ton of questions they answered easily. They have always gone above and beyond for me, I couldn’t imagine going elsewhere for my taxes. Thank you!

Maximize Your Wealth with Smart Tax Strategies

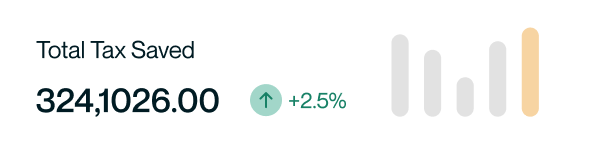

Most business owners and high-income professionals unknowingly pay more taxes than required. With the right tax strategy, you can reduce your tax burden, grow your wealth, and achieve financial freedom—legally and ethically

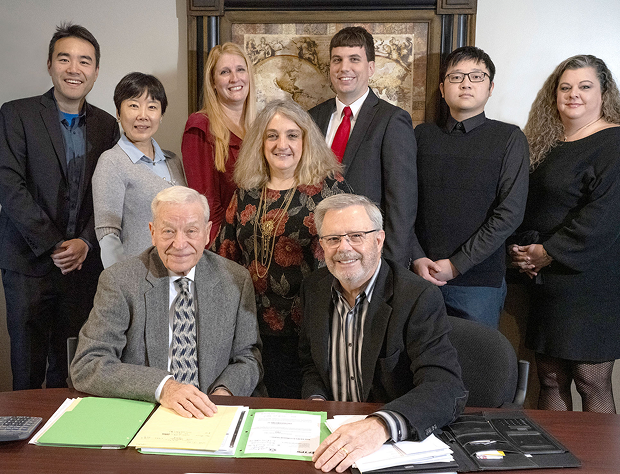

15+ Years

Of Proven Experience

Meet Yazhou Hu

A trusted tax strategist dedicated to helping entrepreneurs, investors, and business owners optimize their tax savings.

With years of expertise, Yazhou has helped countless professionals implement proactive tax strategies that protect their income and accelerate their financial growth.

How We Help You Save Thousands in Taxes

Tailored Tax Strategies

Every financial situation is unique, and we create customized tax plans to maximize your savings.

Legal Tax Reduction

Ethical and legal ways to lower your tax bill.

Business Growth Focus

Our strategies don’t just save you money; they help scale your business efficiently.

Our Online CPA Services vs. The Market

Simple FunTax

Most Services

Tax Preparation

Tax Consultation

Book keeping

Money-Back Guarantee

Work with Licensed CPA

Responsive Communication

IRS Representation

Smart Tax Strategies to Grow & Protect Your Wealth

Tax Planning & Compliance

Stay compliant while reducing your tax liability.

Business Entity Structuring

Choosing the right entity (LLC, S-Corp, C-Corp) can save you thousands.

Real Estate Tax Strategies

Maximize your deductions & increase your property investments' profitability.

Entrepreneur & Self-Employed Tax Solutions

Get the most out of your business deductions.

Ready to Take Control of Your Taxes?

Schedule a consultation with Yazhou and start saving today!

What others are saying about Us

Ryan Guess

I like everyone here, they are very professional and patient, and help me save a lot of taxes, we have been working together for six years, continue to work together this year!

Edward Young

These are some awesome people. Always busy! But they are busy to help make sure you are taken care of. They are not only experts in the financial game, but experts in customer service. 😊👍

Jordan Earl

Jim and everyone else there we’ve worked with are very thorough and extremely organized. I cannot recommend them enough!

Brian Denny

I am incredibly impressed with the outstanding service and user-friendly customer support provided by Yazhou and his team